Money Management in Forex Risks – Lesson 1

Why is Money Management important in forex?

The right money management is simply the most important factor in becoming a successful trader. Either beginner or professional trader you are, you have to follow some rules to preserve your trading capital. And the most important is: if you have a prudent risk management, then it is almost impossible to lose all of your capital.

Therefore the money management methods are the first concept that you should study when you start learning forex trading. The good news are this is not complicated at all. If you use the well-known 2% rule, where you never risk more then 2% of you capital, then you are already on the right track, but I will recommend you some changes to maximize your profits.

What kind of risks are there?

Variance

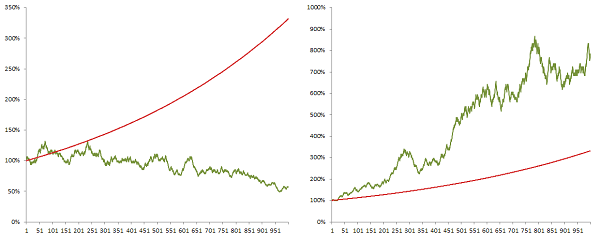

Of course the most obvious risk is variance. Simply, you cannot trade profitable all the time. Sometimes things goes worse than we would expect, but in this case risk management have to prevent the big losses.

Stop loss

Stop loss is closely related to variance. The only thing we can do against variance is to always set a proper stop loss. If you set the stop loss properly, then you can keep control on unpleasant effects of variance and you will never lose all of your money.

Do not keep your money in one place

This is a bit different than the previous two, but this is also very important if it is about money and risk management. Keeping your money on a single forex account means you risk losing all of your money! We have seen bankruptcy, we have seen scams, we have seen organisations disappearing from day to day after working totally fine for years or decades. So why would we keep all of our money in only one place? Just don’t do it.

When you cannot replace losses

The less we can replace money losses, the more important is not to risk it. If you do not have an outside source where you can replace the amount you blow, then you have to take the smallest risk that is possible.

If emotion is associated with your trading

When you get emotionally attached to trades it is going to control you. If you are on tilt, you cannot make rational decisions. You would like to win, so you will close your profitable trade earlier than you should, or you will not end your losing trade in time because you hope the market will change. What is more, tilt can make you forget about stop loss. At the end, you will lose more than you should.

Of course, nobody born as a professional trader. You always have to work on your trading psychology as hard as on your trading strategy.

Useful tips for money management

I would like to share you some useful tips. If you are just getting to know forex trading you should pay attention to these things:

- Open a demo account first. You are not a professional, therefore it is more likely, that you will lose more than win at the beginning. So why would you waste your money, when you are able to get experience for free?

- Think about your trading capital as a money that you can lose anytime. If you can not afford to lose it, do not trade with it.

- Never keep all of your money at only one broker account. Use Skrill or Neteller from where you can move your money instantly. I personally store my money in 7-8 places, and except one of my investment none of them total up to 15% of my whole capital.

- It can not be repeated often enough: you are a winning trader for nothing if you take too much risk. Everyone has downswings and your capital has to survive all of these hard periods.

- Your money management depends on your strategy. Sometimes risking 10% of your capital is totally safe, sometimes risking 3% of your capital is too risky. It is all about risk / reward ratio. With higher risk / reward and higher win ratio we can take more risk. Of course, if we can handle it psychologically.

Comments

1 Comment

[…] the Forex Risk and Money Management Part 1 you could read about the types of risks and now in the Part 2 you will learn how to manage the […]

Leave a Comment