What is Pip in Forex Trading

If you’re interested in forex, you’ve likely heard the term ‘pip’ or ‘pips,’ which is a common concept in forex trading. But what exactly is a pip in forex? This article will explain what a pip is in forex trading, as well as the meaning of forex pips and how useful they are while trading forex.

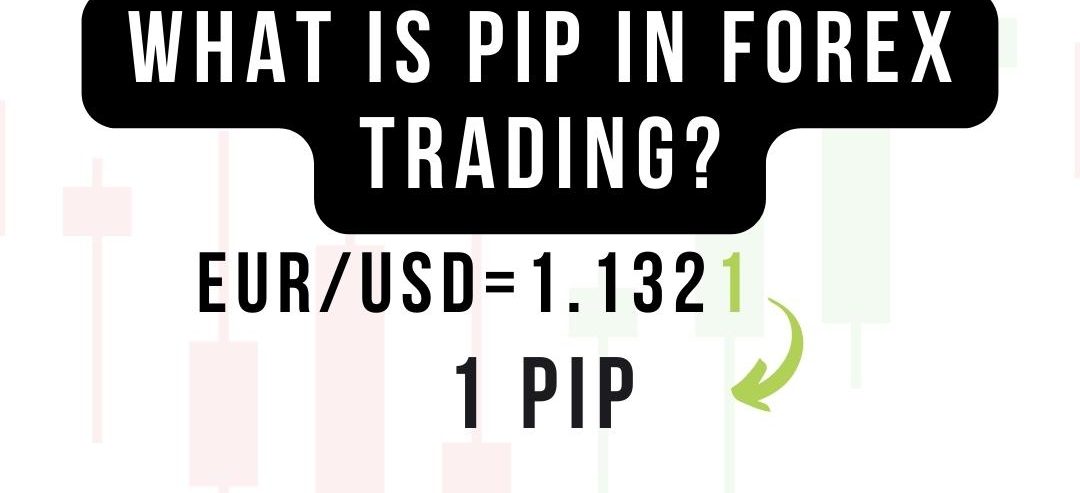

What is a pip (forex trading)

A pip is an incremental price movement having a specific value determined by the market. Simply said, it is a standard unit of measurement for estimating how much a conversion rate has changed in value.

Originally, a pip was the smallest increment in which an FX price would vary, but with the advancement of more accurate methods of pricing, this old-school definition of a forex pip no longer holds true.

Originally, FX prices were quoted to a fixed number of decimal places – most commonly four – and a forex pip was set as a single-point movement in the final decimal place which is quoted.

Many broker companies now quote forex pip value to an extra decimal place; however, this implies that a pip in forex is frequently no longer the final decimal place inside a quote. It remains a standardized value across all brokers and platforms, making it particularly useful as a measure that allows traders to constantly communicate in the same terms without confusion.

Calculate the Value of a Pip

The next stage in answering the question, “What are pips in forex?” and digesting the meaning of pips is to understand how to calculate forex pips. One pip in forex is a movement in the fourth decimal place for most currency pairs. The pips in forex pairs involving the Japanese Yen are the most notable exceptions. One forex pip is a movement in the second decimal place for pairs involving the JPY. The forex pip points table below displays forex pips rates for several common currency pairs.

Let’s look at an example of a forex pip to better understand what they imply. The answer to the question of how much a pip is worth is found by multiplying your position size by one pip. For example, suppose you wish to trade the EUR/USD currency pair and decide to purchase one lot.

One lot is worth 100,000 EUR. For EUR/USD, one forex pip is equal to 0.0001. As a result, the currency value of one forex pip for one lot is $100,000 x 0.0001 = $10. As a result, we can calculate that the profit or loss for this forex pair will be $10 per pip.

To demonstrate the meaning of pips, consider the following basic example of a pip in forex:

Assume you buy the EUR/USD at 1.16650 and then sell one lot at 1.16660 to close your position. The difference between the two is as follows:

1.16660 – 1.16650 = 0.00010

In other words, the difference is one forex pip. You will have made a $10 profit. We can further illustrate the answer to the question, “What is a pip in forex trading?” if we work at these sample numbers from a different angle.

What causes pip values to change?

The pip value of various different currency pairs is determined by the base value of a trader’s account. If the currency pair contains USD as the second quoted currency, the pip value will always be $10 on a standard lot, $1 on a mini lot, and $0.10 on a micro lot for a USD-denominated account, which is common for the most traded currency pairs.

Pip values would change only if USD was either the initial (base) currency in the currency pair or was not included in the pair, and if the value of USD moved prominently in either direction by more than 10%.

Currencies not quoted to four decimal places

The Japanese Yen is the most notable currency in this country. Currency pairs involving the yen have typically been quoted to two decimal places, hence forex pips for such pairs are determined by the second decimal place.

So, here’s how forex pips are computed for the USD/JPY currency pair: If you sell one lot of USD/JPY, a price movement of one FX pip lower will reward you 1,000 yen.

Final Words

Pips are used by forex traders to measure price movements as well as profit and loss. Pips are also important in risk management. A trader, for example, might point out a stop-loss for a trade in terms of pips, which can limit the potential losses on a losing trade.

Pips can assist forex traders in calculating the best appropriate position size in order to avoid taking unnecessary risks by opening positions that are too large with the potential for large losses. Learn more about developing your own forex trading strategy, such as swing trading, day trading, and forex scalping.

Comments

Leave a Comment